Despite the setbacks and operational challenges brought on by the pandemic and ongoing turbulence in global economies, analysts are very optimistic on the aerospace and defense (A&D) industry, expecting annual earnings growth of 12% over the next 5 years.

According to the Aerospace & Defense Global Market Report 2022, the A&D market is expected to grow from $700.30 billion in 2021 to $755.24 billion in 2022 at a compound annual growth rate (CAGR) of 7.8%. The market is expected to reach $1047.07 billion in 2026 at a CAGR of 8.5%.

These optimistic outlooks are being driven in part by the trends in commercial air travel and customer order activity being more robust than earlier post-COVID expectations, and by the fact that the defense industry was more insulated from the global impact of COVID-19 than the commercial aerospace industry. This momentum is helping bring more focus to new technologies and evolving business models and the push for more digital and operational efficiencies.

Industry Trends to Watch

In its 2022 Aerospace and Defense Industry Outlook report, Deloitte explored seven industry trends to watch. Following are highlights of those trends:

- Digital thread and smart factory—embracing digital thread and smart factory can provide essential material and component supply visibility. Doing so will facilitate efficient production and faster design to delivery, helping A&D companies stay nimble in today’s shifting business environment.

- Aftermarket—the recovery in air travel is expected to increase the focus on digital innovation for growing aftermarket revenues.

- Advanced military capabilities—innovation can build advanced military capabilities for defense contractors. With the U.S. military gradually moving its focus away from the Middle East to emerging threats in the Far East, defense companies should emphasize building improved capabilities in fighter aircraft, space resilience, shipbuilding, and cybersecurity to drive growth.

- Space market—developments along three key areas—the launch industry, satellite trends, and new technology—have the potential to drive growth in space-based services.

- Advanced air mobility (AAM)—as the market for AAM in the United States alone is estimated to reach $115 billion annually by 2035, competition is expected to be fierce. That means companies in this ecosystem have the ability to gain an advantage by being first movers.

- Decarbonization—there is increased pressure to implement environmentally sustainable manufacturing practices and promote a significant shift toward lowering carbon emissions. While the industry has been at the forefront of adopting new and advanced manufacturing technologies to increase fuel efficiencies, A&D companies should leverage advanced technologies now more than ever to help address the sustainability challenges through innovation.

- Mergers and acquisitions (M&A)—innovation, technology transformation, and geopolitical and regulatory shifts will likely lead to a vigorous deal environment across all industry segments.

Space-Based Economy

As mentioned above, the space market promises to be a growing trend over the foreseeable future. An analysis by McKinsey & Company found the total commercial space economy today to be greater than $350 billion. This figure includes commercial satellite-based services (data), satellite manufacturing, and space tourism.

McKinsey released a 2022 report, the role of space in driving sustainability, security, and development on Earth, that interviewed c-suite executives and national space agency directors, plus other luminaries from the worlds of government, academia, and the investor community. The report found that rapid technological progress is unlocking new capabilities, encouraging more commercial funding in space, and making space more accessible for nations and the private sector. These developments are sparking more competition as space becomes crowded, and public and private players scramble to claim finite resources such as orbits and spectrum.

Labor Challenges

The A&D industry was not immune to the effects of COVID on the workforce. As Ernst & Young stated in its 2021 A&D Workforce Study, workforce and talent concerns rank high in A&D companies. Business innovation requires a flexible, dynamic workforce composed of many types of workers, both remote and on-site, one with enhanced digital skills and continued focus on the development of engineering knowledge. It’s more important than ever to consider how to retain talent, and keep teams engaged, developed, and motivated.

Will these aforementioned trends be major factors five years from now? Will the growth predictions turn out to be accurate? Only time will tell. But for the here and now, A&D companies need to focus on innovation and agility to meet customer needs and position themselves for success for many years to come.

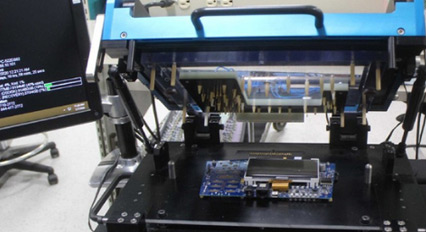

Spartronics has advanced capabilities for the manufacturing of commercial Aerospace & Defense applications to help A&D original equipment manufacturers (OEMs) adapt to an ever-changing world.